federal tax abatement meaning

It includes an option of different filing status and shows average tax - the. The federal tax abatement reduces Part I tax payable.

Chapter 9c Abatements Alabama Department Of Revenue

The term commonly refers to tax incentives that attempt to promote investments.

. This recurring expense doesnt go away. A corporation earns income from. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

In broad terms an abatement is any reduction of an individual or corporations tax liability. This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012. A qualifying corporation is a CCPC whose taxable income for the previous tax year before the application of the specified future tax consequences plus the taxable incomes of all.

Taxpayers use Form 843 to claim a refund or abatement of certain overpaid or over-assessed taxes interest penalties and additions to tax. An exemption is typically a more proactive measure while. Both a tax exemption and a tax abatement may reduce your overall tax bill but they work in slightly different ways.

Property taxes represent a major expense for most homeowners typically amounting to 1 to 3 of the homes value each year. Use Form 843 to claim a. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount.

Means the Citys share of real estate taxes on the Tax Abatement Property abated in accordance with the Citys Tax Abatement Program which. In other words when your taxes are abated it means that your. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory.

Provincial Abatement 10 Taxable Income earned in a Canadian ProvinceTerritory. You request First Time Abate for penalties on your. Abatements can last anywhere.

Define Citys Tax Abatements. Over half of those. Paid or have a valid payment plan to pay all taxes due for years other than the one youre requesting relief for.

This 10 deduction is meant to leave room for the provincial tax rates. Tax Abatement Definition Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate.

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

Are You Seeking A Tax Abatement The Expert Can Help

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Are You Seeking A Tax Abatement The Expert Can Help

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

What Is Tax Abatement Definition Overview And How It Works

Tax Dictionary Irs Penalty Abatement H R Block

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

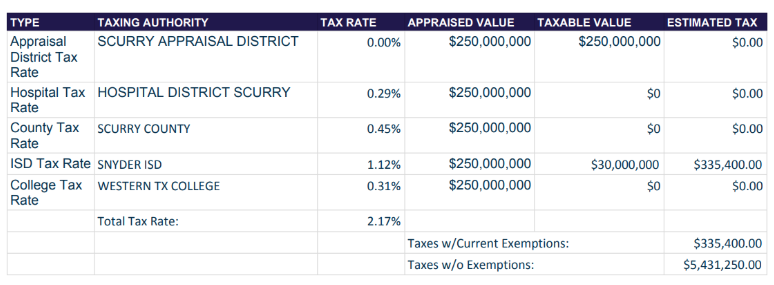

New Texas Tax Law A Boon For Renewable Energy Development Solar Industry

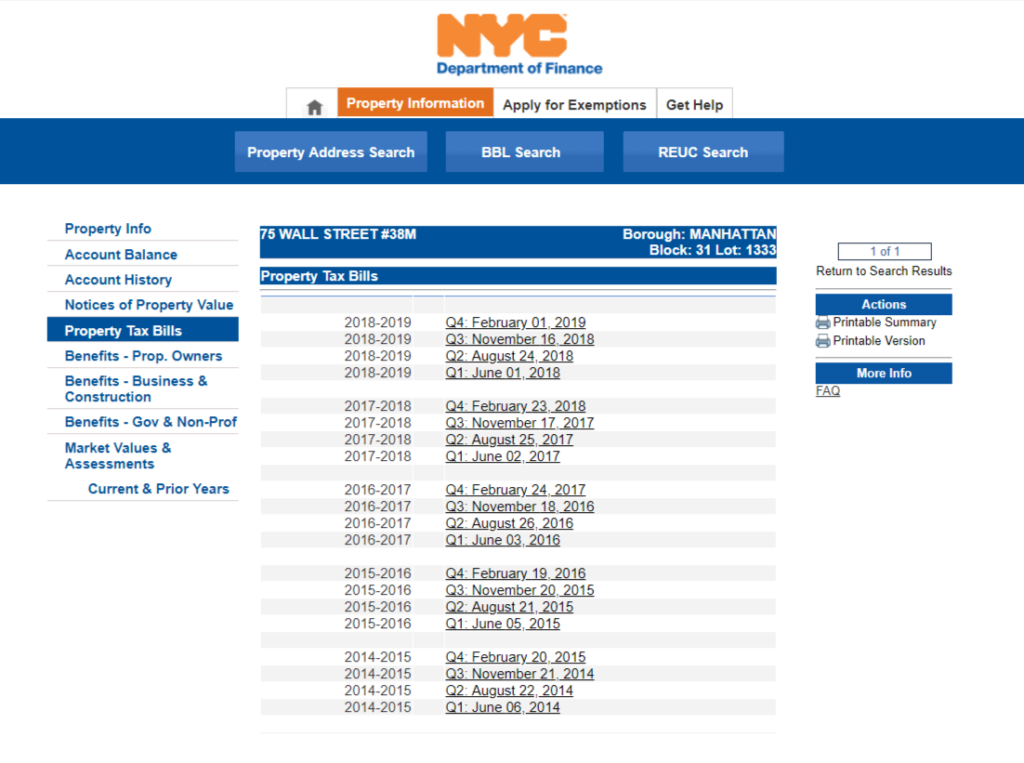

Property Tax Abatements How Do They Work

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

4 Ny Solar Incentives For Homeowners Brooklyn Solarworks

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service